Budget 2021 Uk Capital Gains Tax

Sunak did not mention any rises in capital gains tax itself how much gains are taxed above the threshold and neither does the 2021 budget. UK Budget 2021.

The States With The Highest Capital Gains Tax Rates The Motley Fool

The threshold for capital gains tax is frozen at 12300 until 2026.

Budget 2021 uk capital gains tax. As announced today the capital gains tax threshold will stay the same at 12300 until 2026. As announced at Budget the government will introduce legislation in Finance Bill 2021 that maintains the current Capital Gains Tax annual exempt amount at its present level of 12300 for. For the 2020 to 2021 tax year the allowance is 12300 which leaves 300 to pay tax on.

First deduct the Capital Gains tax-free allowance from your taxable gain. Chancellor can go down in history as a great reformer if he fixes the disparity with income tax in Wednesdays budget Last modified on Tue 26 Oct 2021 1116 EDT Wednesdays budget. Rather he has frozen the capital gains tax threshold until 2026.

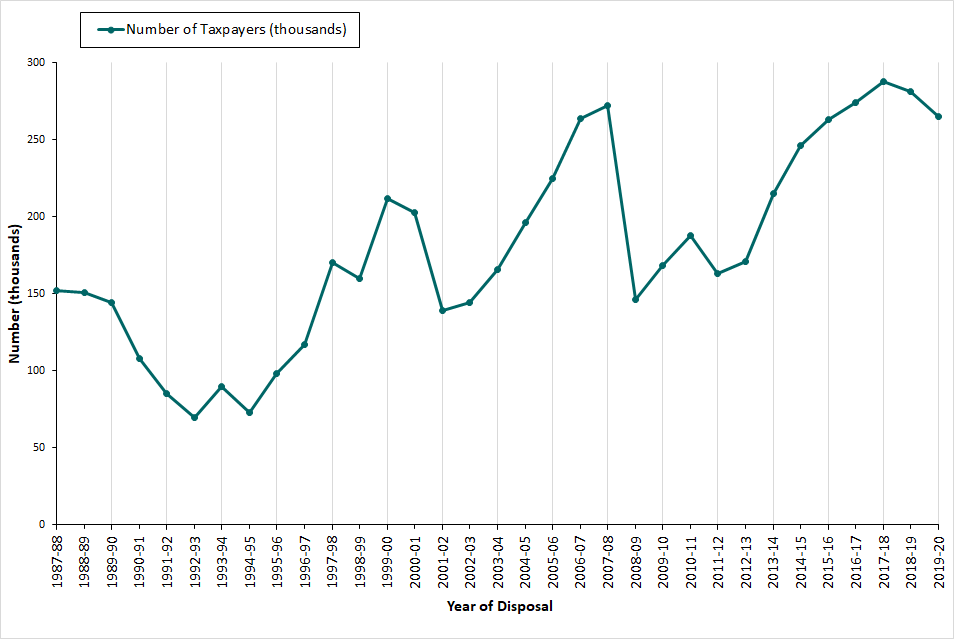

Over the past five years HMRC receipts from CGT have risen 62 per cent from 71 billion in 201516 to 115 billion in 202021. Please click here to go back to other Budget 2021. 2021 autumn budget predictions.

While it hasnt been reduced it is also a stealth tax because it hasnt been increased in line with inflation. The penalty increased to 5 after six months. Rishi Sunak might be planning to increase the rate of Capital Gains Tax.

The CGT annual exempt amount will remain at its current level until 5 April. Home Business News Autumn Budget 2021. Tax rates and allowances.

Budget 2021 uk capital gains tax. According to The Times there are rumours that Rishi Sunak may announce a change in the capital gains tax rates. Raising Capital Gains Tax CGT or National Insurance contributions NICs could do more harm than good when it comes to boosting Britains economy.

For those selling UK residential property the deadline to file a tax return has been extended from. As Sunak bids to take the UK economy out of the deep freeze. For months now there has been speculation that capital gains tax rates will go up in the forthcoming Budget.

What the property tax rate is and how it could change today The Chancellor has long been rumoured be considering bringing capital gains tax. Raising Capital Gains Tax CGT or National Insurance contributions NICs could do more harm than good when it comes to boosting Britains economy after the. Autumn Budget 2021 rumours Capital gains tax.

Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021. Speculation amongst property analysts ahead of todays Budget is that the industry may be hit with rising Capital Gains Tax. It had been widely speculated that the 2021 Budget would bring some level of reform to the CGT regime but capital taxes hardly featured in the Chancellors announcements.

No changes were announced to the rates of capital gains tax with the higher rate remaining at 20 and the basic rate at 10. Will capital gains tax increase at Budget 2021. The content of this article is intended to provide a general guide to the subject matter.

Gift an asset Give it away Transfer it to someone else. Current capital gains tax rates of 10 and. The rate you pay depends on your income level and the type of asset.

The annual exemption for 20212022 will remain at 12300 and the Chancellor announced that the annual exemption will remain at this amount for the tax years 202122 to 202526. The British economy which suffered under the COVID-19 pandemic has been propped up by the furlough scheme and a number of other financial emergency placing pressure on the Exchequers purse. It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget 2021 on 3 rd March.

Price Reduction Need To Act Now Dixcart Group Limited. Changing the capital gains tax rate would require a tax bill to pass Congress and be signed. St Kitts And Nevis Citizenship By Investment.

Capital Gains Tax rules change kicked in at midnight. UK Tax Capital Gains Tax Corporate Tax. People in the UK.

Chancellor Rishi Sunaks Budget did not ignore Capital Gains Tax after all. Budget 2021 uk capital gains tax. Add this to your taxable income.

Tax increases must be carefully measured. Figures released by HMRC yesterday show how big an earner CGT is already. Now may be a good time for tax planning before rules do change.

Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021. UK residents are only required to file a return where the disposal results in capital gains tax while non-UK residents are required to file a return even if there is no capital gains. CAPITAL GAINS TAX is thought to be Chancellor Rishi Sunaks number one tax target in next Wednesdays Budget and he could more than double it to a maximum 45 percent.

Will the capital gains tax rates increase in 2021. Budget 2021 uk capital gains tax. Instead it was simply announced that the current level of annual exemption the amount of capital gain that each person can make free of tax each tax year of 12300 will remain in place until 202526.

Despite record levels of MA activity in the build-up to the Budget with Azets advising on 50 deals in just ten weeks no announcement was made and CGT reform was again overlooked on Tax. The threshold is currently frozen until 2026 currently 12300 but the rate may be amended later this month. Budget 2021 uk capital gains tax.

Will Capital Gains Tax Rates Increase In 2021 Implications For Business Owners Bdo

U K Treasury Told To Avoid Tax Increases As Budget Deficit Growsby Alex Morales David Goodman And Andrew Atkinson2 Capital Gains Tax The Borrowers Budgeting

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Govt Deprived Of Tax On Capital Gains Icab In 2021 Capital Gain Business Pages Business

Guide To Capital Gains Tax Times Money Mentor

How To Avoid Or Cut Capital Gains Tax By Using Your Tax Free Allowance Getting An Isa And More Lovemoney Com

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Budget 2021 India In 2021 Budgeting Ration Card Tax Holiday

Capital Gains Tax Spreadsheet Shares In 2021 Capital Gains Tax Capital Gain Spreadsheet Template

Main Residence Property Sale New Capital Gains Tax Implications Kirk Rice

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Tds Rate Applicable On Mf Redemptions By Nris For Ay 2021 22 Mutuals Funds Capital Gain Fund

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

Entrepreneurs May Feel Why Bother Rishi Sunak Set To Hit Self Employed With More Taxes Personal Finance Finance Express Co Uk

Capital Gains Taxes Are Going Up Tax Policy Center